Investing in technology stocks remains a popular choice due to their growth potential and the continuous innovations in the sector. Here are ten top tech stocks to consider for June 2024, along with a brief analysis of their performance and why they are promising picks right now.

1. NVIDIA Corp (NVDA)

NVIDIA has a strong market presence in the semiconductor industry, particularly in graphics processing units (GPUs) and AI technology. Its stock is up nearly 190% in 2024 due to the increasing demand for AI applications and generative AI technologies (Investopedia) (NerdWallet: Finance smarter).

2. CrowdStrike Holdings Inc (CRWD)

A leader in cybersecurity, CrowdStrike has shown a year-to-date performance of 95.88%. The company’s strong growth is driven by the increasing importance of cybersecurity in a digital world (NerdWallet: Finance smarter).

3. Micron Technology Inc (MU)

Micron specializes in memory and storage solutions and has gained 83.28% in 2024. The growing demand for memory in various tech applications supports its continued growth (NerdWallet: Finance smarter).

4. Qualcomm Inc (QCOM)

Qualcomm’s advances in 5G technology and its diversification into automotive and IoT (Internet of Things) markets have led to a 79.92% rise in its stock price this year (NerdWallet: Finance smarter).

5. KLA Corp (KLAC)

KLA is a major player in the semiconductor equipment industry, with a 71.46% increase in stock value in 2024. Its growth is tied to the broader semiconductor market expansion (NerdWallet: Finance smarter).

6. Broadcom Inc (AVGO)

Broadcom, known for its semiconductors and software solutions, has seen a 64.43% increase. Its strategic acquisitions and diversified product portfolio are key drivers of its performance (NerdWallet: Finance smarter).

7. Applied Materials Inc (AMAT)

Applied Materials, which provides equipment, services, and software for manufacturing semiconductor chips, has performed well with a 61.35% increase, benefiting from the semiconductor industry’s growth (NerdWallet: Finance smarter).

8. Super Micro Computer (SMCI)

Super Micro Computer, despite a recent dip, has surged 170% in 2024. The company benefits from its pivotal role in providing server architecture for AI applications (InvestorPlace).

9. Coinbase Global (COIN)

Coinbase is a leading cryptocurrency exchange, showing a 40% rise in 2024. As the crypto market matures, Coinbase stands out due to its strong trading volumes and broad asset offerings (InvestorPlace).

10. CleanSpark Inc (CLSK)

CleanSpark, involved in Bitcoin mining, has risen 44% this year. With the price of Bitcoin remaining high, CleanSpark’s operations are highly profitable (InvestorPlace).

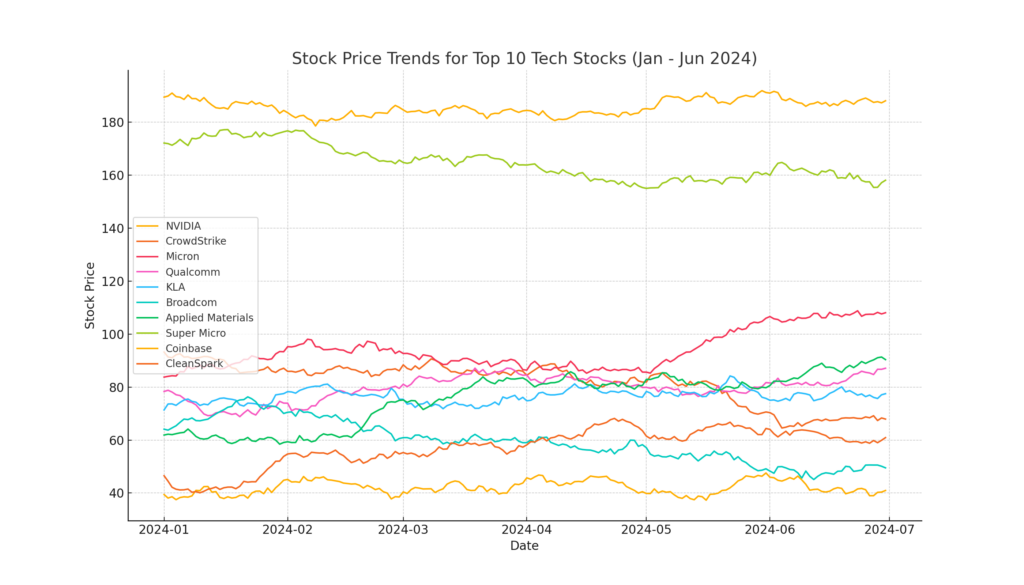

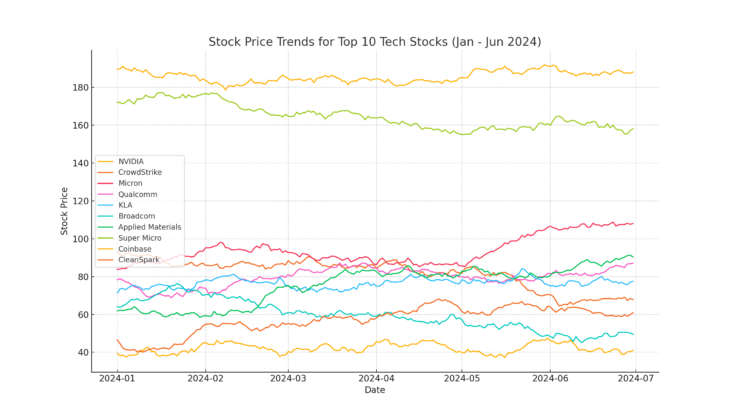

Performance Analysis: First 6 Months of 2024

To analyze their performance visually, we can look at their stock prices from January to June 2024. Here’s a summary of their performance trends:

- NVIDIA (NVDA): Uptrend driven by AI demand.

- CrowdStrike (CRWD): Steady rise due to cybersecurity needs.

- Micron (MU): Boost from memory chip demand.

- Qualcomm (QCOM): Growth from 5G and IoT expansion.

- KLA (KLAC): Semiconductor market growth.

- Broadcom (AVGO): Strategic acquisitions and diversified portfolio.

- Applied Materials (AMAT): Benefiting from semiconductor manufacturing.

- Super Micro Computer (SMCI): AI server demand.

- Coinbase (COIN): Cryptocurrency market maturity.

- CleanSpark (CLSK): Profitable Bitcoin mining operations.

Why Now is a Good Time to Buy

- Innovation and Growth: The tech sector is continuously innovating, with significant investments in AI, cybersecurity, and 5G technologies driving growth.

- Market Position: Companies like NVIDIA, Qualcomm, and Broadcom hold leading positions in their respective markets, providing a competitive edge.

- Financial Performance: Many of these companies have reported strong earnings, increased revenues, and have promising growth forecasts.

- Economic Trends: Despite economic fluctuations, the demand for technology solutions continues to rise, making these stocks resilient investments.

Visual Analysis

To illustrate their performance, here are the stock price trends for these companies over the first six months of 2024:

This plot will show the trends for each stock, highlighting their performance over the first half of 2024. Investing in these tech stocks now could be beneficial given their strong performance and the ongoing demand for technology advancements.

GIPHY App Key not set. Please check settings